Banking on the future

Enterprise data management initiative for financial institution

01. Question

Cashing in on the digital evolution is no walk in the park, especially in the financial services sector. As a niche player in the industry, the client in this case study can be labelled as a highly data-driven organisation. Nevertheless, there were opportunities for improvement in the methods they employed to collect, store and manipulate data. The company’s reliance on outdated legacy procedures and software presented challenges to the reliability of the company’s output. All it takes to lose a crucial set of numbers on a shared file server is a stroke of bad luck. The use of ageing physical infrastructure also led to further compliance issues. In addition, some advanced analytical models simply couldn’t be run on their old systems.

This prompted our client to kick off an internal strategy initiative focused on enterprise data management (EDM). The first stage of the strategy execution focused on centralisation and uniformisation of data sourcing activities. As a result, data collection from external partners and sources is now centralised under a single data collection team, employing standardised tools. This marked a significant improvement from the previous situation, where different teams were often collecting similar data from the same sources, using different software applications.

Next to the aspect of streamlining data collection, our client was looking for more efficient ways for data storage and accessibility. They needed assistance in supporting the EDM team as they progressed through the strategy program’s subsequent stages. That’s where our role began.

02. Process

Four of our consultants joined as embedded members in charge of dedicated project teams, taking the lead on various improvement tracks running in parallel. During the first stage, we conducted interviews with teams across the organisation to gain a comprehensive understanding of the current data landscape. Using our trademark methodologies, we meticulously captured all existing documentation and tacit knowledge, successfully mapping the entirety of the client’s data landscape within a mere three weeks. Simultaneously, we documented all processes and data flows of one of the client’s key departments.

After charting the financial institution’s data environment, we collaborated with the client’s architectural team to design a future data and information architecture. Our approach began by identifying all the necessary functional components required to create a single, unified environment where all data would be easily accessible. We explored the technical possibilities for each of these building blocks, actively involving key staff from every department to provide their input and explore various avenues. A key role was reserved for the IT team, which was closely involved in the creation of the solution – generating additional team buy-in in the process.

03. Insights

Given the unique technical architecture and setup of our client – which differed considerably from typical insurance or banking players –, we relied heavily on the combination of the client’s expertise and our own. With no existing frame of reference as a starting point, we undertook a collaborative effort to create our own problem-solving framework.

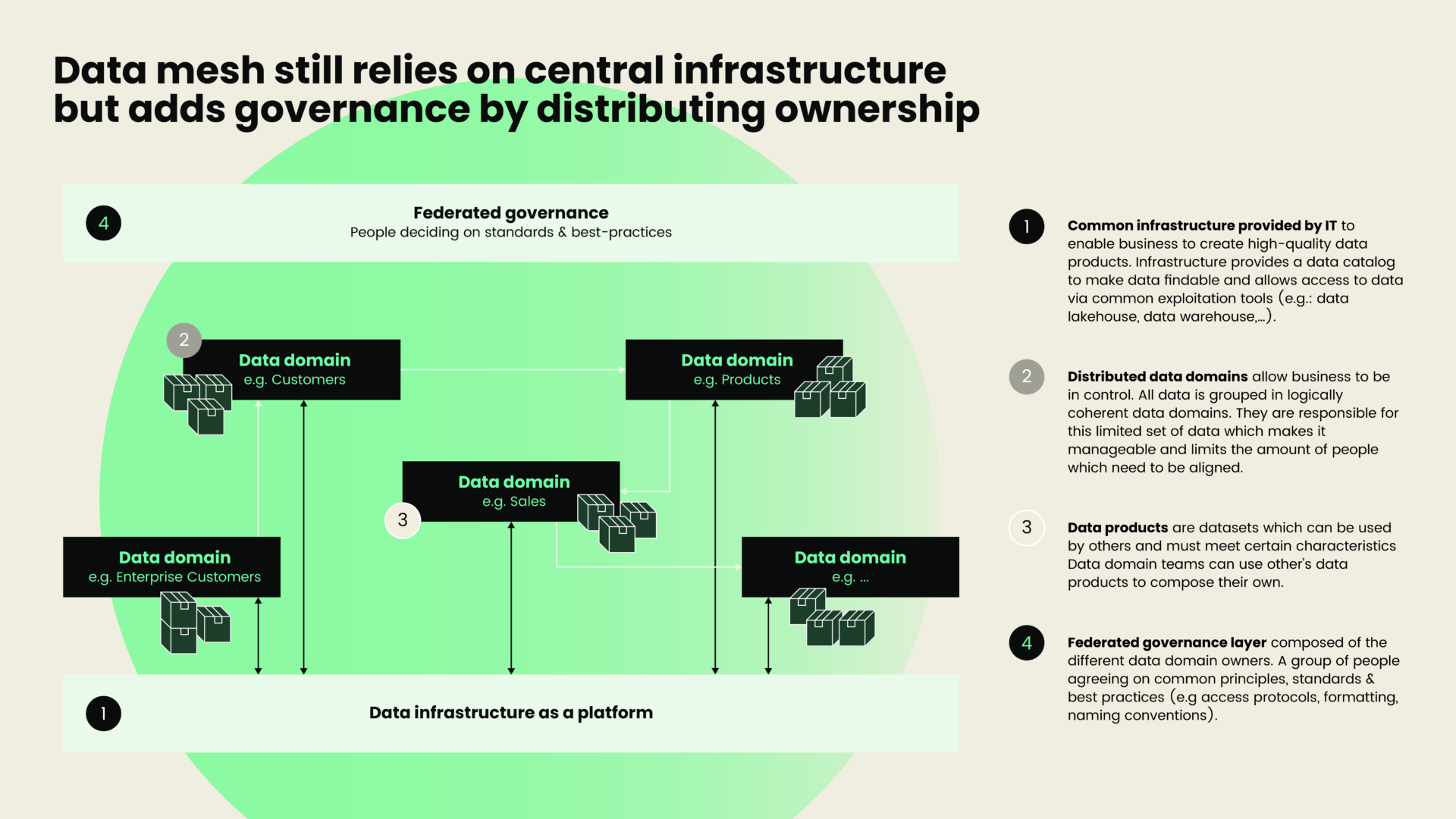

In this case, we opted for a distributed data mesh architecture. This is a departure from the conventional, standardised data warehouse architecture commonly found in financial institutions. This choice is ideally suited for organisations with a more siloed and decentralised nature that rely on extensive data exchanges to operate.

We further led the way to fill in the architectural framework and implement specific technologies aimed at improving data management, including a data catalogue and master data management solutions. We also provided support to the IT department and end users in setting up and using these new platforms and applications.

04. Results

The client now has a comprehensive overview of their existing data landscape, including data streams, available data sets, storage locations, as well as the teams and tools involved. We also laid out a roadmap for the future, outlining an ideal data and information architecture on both technical and functional levels. Lastly, we assisted in formulating the RFP procedure for selecting a master data management tool and a partner for its further implementation.

One of the key challenges for organisations looking for expertise in this kind of IT decision-making is finding impartial guidance. Our combination of specialised technical knowledge and methodologies allows us to make truly technology-agnostic decisions without dependence on any external IT partner. This approach mitigates the risk of tunnel vision or context blindness that could ultimately lead to unwanted vendor lock-in. Coupled with our experience in the financial sector and our ability to navigate diverse teams and find compromises, we always make sure to deliver solutions that are supported across all of our clients’ teams.

Want to know more about this case?